ISLAMABAD: In response to a surge in global oil rates, Caretaker government has announced a significant increase in petroleum product prices, with some products seeing a rise of up to Rs20 per litre.

The decision comes as the international market witnessed a substantial uptick in petroleum prices over the past fortnight. Consequently, consumer prices in Pakistan are also set to be revised, according to a statement released by the Finance Division on Tuesday evening.

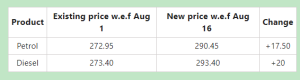

Specifically, petrol prices are being raised by Rs17.50 per litre, while the cost of high-speed diesel (HSD) will see a hefty hike of Rs20 per litre. These new fuel prices are slated to take effect from August 16, impacting consumers across the country.

This announcement follows a previous increase in fuel prices initiated by the former Pakistan Democratic Movement (PDM)-led government on August 1. The former government, citing the upward trajectory of global oil prices, had raised petrol and diesel costs by a substantial Rs19 per litre. Originally scheduled for announcement on July 31, the new rates were held back by officials who sought to gauge and potentially mitigate the impact of the price surge on the already inflation-weary population.

Ishaq Dar, the then Finance Minister, delivered this announcement as one of his final acts in office before the dissolution of his government on August 12. Dar justified the inevitability of the increase, pointing to Pakistan’s agreement with the International Monetary Fund (IMF) to implement a petroleum development levy (PDL) tied to the prevailing rates.

However, this latest fuel price hike is anticipated to trigger a renewed wave of inflation in August. The country had previously faced a peak inflation rate of 38% in May. Despite a nominal decrease in inflation over the subsequent month, the State Bank of Pakistan (SBP) opted to maintain the key interest rate at a high 22%. The Monetary Policy Committee (MPC) noted the potential for a downward trend in year-on-year inflation over the coming year, signaling the emergence of a significant positive real interest rate.

Pakistan’s economy has been grappling with severe financial mismanagement, worsened by the compounding effects of the COVID-19 pandemic, a global energy crisis, and destructive floods that submerged a substantial portion of the country in the past year.

Amid these challenges, Pakistan managed to secure a $3 billion standby deal with the International Monetary Fund (IMF) last month, offering a temporary respite for the nation’s burgeoning foreign debt.

However, the terms of this deal necessitate the abandonment of several subsidies aimed at assisting the impoverished. Notably, the current fuel price hike aligns with the broader trend of rising global oil prices.

(Islamabad51-Newsdesk)