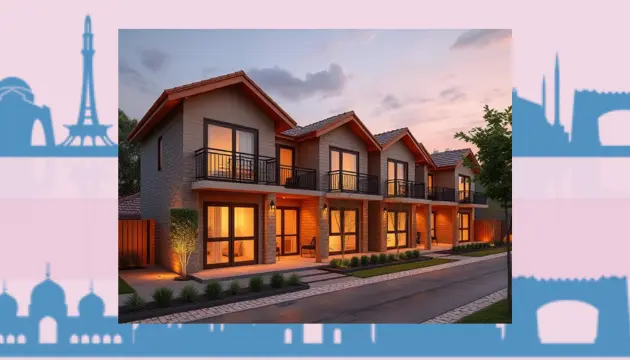

ISLAMABAD: The federal government is finalising a new housing scheme aimed at providing affordable homes to low-income families and mortgage options for the middle class. The plan includes the construction of 200,000 low-cost housing units, with 50% subsidy on financing, to be built under government sponsorship.

Prime Minister Shehbaz Sharif is expected to formally announce the initiative soon, which aims to revive the struggling housing and construction sector — and its 72 linked industries.

According to sources, the government is considering two main options: either directly constructing 3-5 marla houses and offering them at subsidised rates, or providing 50% subsidised funding for individuals to build the homes themselves.

A meeting chaired by Federal Planning Minister Ahsan Iqbal on Monday discussed the challenges in affordable housing and long-term financing. It was attended by State Bank of Pakistan (SBP) Governor Jameel Ahmed, private and public bank heads, and officials from the Pakistan Mortgage Refinance Company (PMRC) and other stakeholders.

The SBP and bank representatives have been given a week to provide feedback on the proposed model. Another meeting is expected next week.

Officials say Pakistan is currently facing a serious housing shortage, with a gap of around 12 million homes. The country requires nearly 700,000 new housing units each year, but only about 250,000 are constructed annually — resulting in a shortfall of 450,000 homes. Approximately 65% of this deficit impacts low-income households, followed by 25% in the lower-middle-income segment, and 10% in the upper-middle-income category.

Participants pointed out that while the demand for housing remains high — particularly among the 64% of the population under the age of 30 — key barriers include unaffordability, limited access to housing loans, and rising costs of land and building materials. Builders also face financial risks, small profit margins, and regulatory obstacles.

To explore workable solutions, the meeting examined effective housing finance models from countries such as Singapore, Turkey, Brazil, India, and South Africa. Ahsan Iqbal stressed the importance of establishing a long-term, mortgage-based housing finance system — similar to vehicle leasing — to help salaried individuals become homeowners.

ALSO READ >>> Punjab CM approves Rs5,000/acre wheat subsidy for 600K farmers

“Millions live their whole lives in rented homes. A house should not be a dream out of reach,” said the minister. “An average income earner cannot build a house worth two or three crore rupees in one go.”

He said the government is willing to give 100% guarantees to banks to secure their capital and encourage housing loans. He urged banks to create their own market-based loan products, with the government supporting smaller units like 3-marla houses through targeted subsidies.

Member Infrastructure Waqas Anwar presented a financial framework prepared by the Planning Ministry. It was also shared that the Punjab government is preparing to launch its own housing scheme.

The Planning Ministry will coordinate with the Law Ministry to ensure legal and regulatory support.

“This effort is not just about housing — it’s about boosting the economy, creating jobs, and improving lives,” Iqbal said. Banks expressed willingness to work with the government on a workable model for affordable housing.

The initiative is being seen as a major step toward addressing the housing crisis in Pakistan and supporting the country’s economic growth.