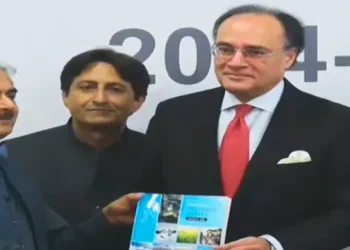

ISLAMABAD: Finance Minister Muhammad Aurangzeb emphasized the urgent need for structural reforms in the energy sector to address issues related to independent power producers (IPPs), inflated electricity bills, and other irregularities that burden the national exchequer and consumers.

“We need to move towards structural solutions. We have provided an immediate solution, but we must also follow through with structural reforms,” the minister said during a press conference in Islamabad.

His comments come amid outcry over capacity payments being made to IPPs through consumers’ monthly electricity bills, which are already burdened with taxes and the highest tariffs in the country’s history.

Political leaders, civil society, and the public have criticized the government for raising electricity rates and have asked officials to review their agreements with power companies.

The Jamaat-e-Islami (JI) has also protested in the streets, holding a sit-in in Rawalpindi against the payments to power companies and the high electricity bills.

Cash-strapped consumers are being forced to pay skyrocketing power bills at a time when the headline inflation rate has reached 12.6% in June 2024.

“We can make emotional decisions and react emotionally, but we also need to attract both local and foreign investment. We cannot completely disregard the integrity of our agreements with the IPPs,” Aurangzeb said.

The finance minister emphasized that short-term and knee-jerk reactions will not lead to a comprehensive structural transformation of the country’s various economic sectors.

Even though the government has taken steps like introducing an industrial package, ending cross-subsidies, and giving subsidies to consumers using up to 200 units, more work is still needed.

He stated that the government was making every effort not to burden the low-income section of society and mentioned plans to include agriculture in the tax regime, with chief ministers of all provinces responsible for enacting agri-tax legislation.

The finance minister said there are at least 4.9 million people who don’t file taxes, and the government has information about their lifestyles.