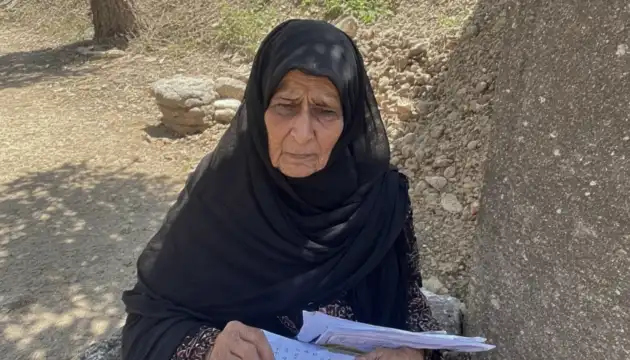

ISLAMABAD: The federal government has introduced a significant change in the budget for 2025-26, limiting the duration of family pension to 10 years after the death of the spouse.

During his budget speech in the National Assembly on Tuesday, the Federal Finance Minister explained that changes made to the pension scheme over the past few decades through executive orders had increased the burden on the national treasury. To correct the pension scheme and reduce this financial strain, the government has introduced several reforms.

The Finance Minister highlighted that these reforms aim to discourage early retirement and link pension increases to the Consumer Price Index (CPI).

He further stated that the family pension, paid after the demise of a spouse, will now be restricted to a maximum of 10 years. Additionally, the government has eliminated the provision of receiving multiple pensions. Another key change is that individuals re-employed after retirement will now have to choose between drawing a pension or their salary; they cannot receive both.

Finance Minister Muhammad Aurangzeb, in his budget speech announced new tax proposals aimed at broadening the tax base. He stated that a long-standing demand from the business community was to tax individuals based on their income, rather than their sources of income.

Following this principle, provincial governments will now also collect tax on agricultural income at the federal income tax rate.

— ALSO READ —

Budget 2025-26 proposes salary, pension hikes for employees

A significant new proposal targets pensioners under 70 years old who receive an annual pension exceeding one crore rupees. These pensioners will face a 5% tax on the portion of their pension that is above one crore ( Rs. 10000000) rupees. The Finance Minister clarified that this measure is intended to widen the tax net.

He emphasized that the government has no intention of imposing taxes on low and middle-income pensioners, reassuring a large segment of the retired population.